Investment Conclusion

Usual Disclaimer: This is not investment advice. I’m just sharing my (brief) thoughts.

I was motivated to look at dLocal ($DLO) because, in general terms, I think payment service providers have very attractive business models and a credible structural tailwind supporting long-term growth in the form of the ongoing global adoption of digital payment methods. I also thought that dLocal has an interesting angle of differentiation as being focused exclusively on serving global merchants doing business in emerging markets.

I believe dLocal can continue to grow revenue at very high rates over the next eight years, starting at 65% year-over-year growth in 2022 and declining to 20% by 2030. High operating leverage means this growth translates to high margins (~65% EBITDA margin on net revenue), while capital efficiency drives free cash flow conversion of 70-80%. dLocal pursues a “land-and-expand” model similar to most SaaS companies, making net revenue retention one of the key metrics to monitor. Their approach to driving NRR expansion is unique, however, as they pursue this not only by trying to penetrate customer organizations deeper via add-on products and closer relationships, but also by partnering with global merchants across an increasing number of emerging market countries. dLocal serves each of their top 10 merchants in an average of 9 countries and this has increased from an average of 4 countries in 2018. Such a dynamic means that rising NRR for dLocal not only means revenue growth, but also means customer relationships that are more defensible, helping to insulate their business from rising competition from global competitors like Adyen and Stripe. Customer churn has historically been less than 1%.

Unfortunately, none of this is a secret and, even after selling off 61% over the past year, dLocal is still trading at a pretty full valuation. So far this year, dLocal has traded more like a growth factor play than anything else and has moved more or less in line with the Nasdaq (see valuation section). In the short-term, while macroeconomic uncertainty persists, I would expect that correlation to continue. There is also a potential headwind in the form of economic pressure on emerging economies from high US interest rates, a strong USD, and commodity price inflation (although the impact of the latter depends on the country). Over the medium and long term, I would expect fundamentals to reassert themselves and believe dLocal can deliver strong levels of free cash flow and very high returns on invested capital.

The problem is that continued rate hikes are eating into the discounted value of those cash flows (same story for lots of growth stocks, hence the correlation with the Nasdaq). My valuation model (which uses a 3.5% risk-free rate) implies only small upside from the current price. This makes it hard for me to want to pile into dLocal at the moment, no matter how much I like the company. The question is whether the quality of the company and the strength of its growth story warrant a small initial position, despite my reservations over valuation. This is more a judgement call than anything else, but I think they do. I think it unlikely that a company of dLocal’s quality would ever become a screaming buy on valuation grounds. In addition, when the macroeconomic parameters change, they will change quickly and I would not want to miss out because I am on the sidelines. By starting with a small initial position I am also giving myself the option to average down should the shares sell off more.

In the rest of this post I look at the company in more detail, broken down into sections as follows:

Company Overview

Business Model

Market Opportunity

Competitive Dynamics

Financials

Valuation

Company Overview

dLocal is an online payment service provider. They enable global enterprise merchants to get paid by their customers (pay-in transactions) and make payments to their suppliers and vendors (pay-out transactions) online in a safe and efficient manner. They also allow small business owners and entrepreneurs to accept payments from their customers via a marketplace product.

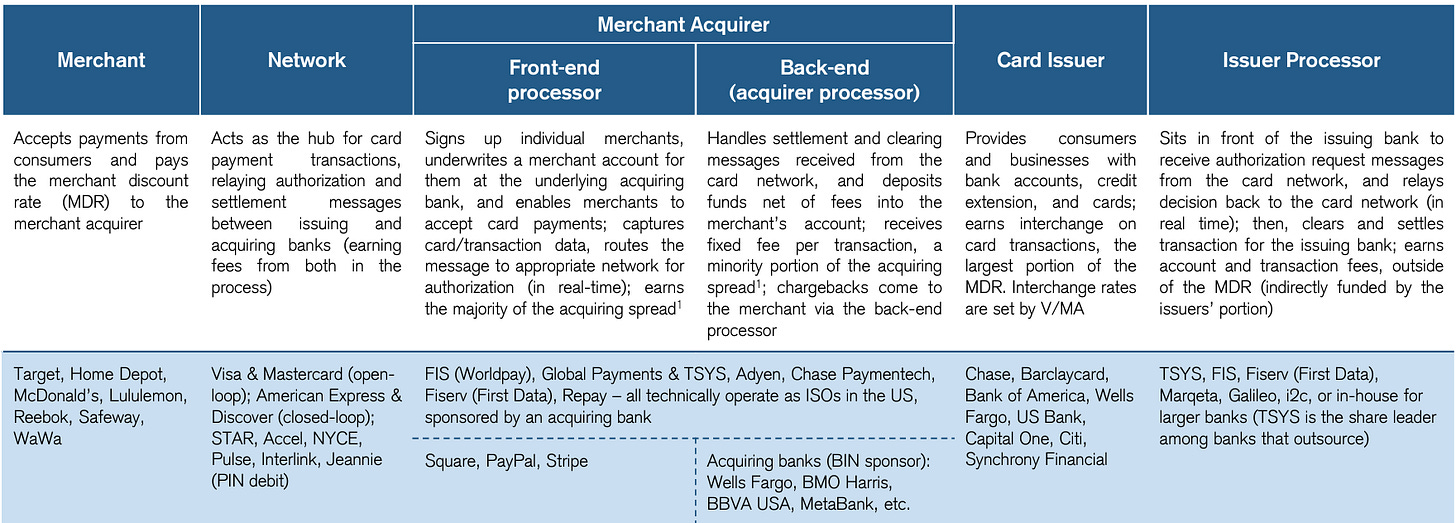

Within the payments value chain they would broadly be classed as a merchant acquirer, similar to Adyen and Stripe. The table below from a Credit Suisse research report provides an illustration of the main parties to an online transaction and shows where merchant acquirers sit in the chain. As dLocal lacks their own acquiring licenses they would count more as a front-end processor.

There is a lot of material available online for those who might like to dig into how the payments industry works, which makes another attempted explanation by me here redundant. Two good places to start would be a research report by Credit Suisse, written in 2020, and the introductory sections of the report on Adyen that Abdullah from MBI Deep Dives wrote recently.

dLocal stands out for its singular focus on emerging markets. They target global enterprise merchants, think Microsoft, Didi, Shopify etc, who wish to accept payments from customers in emerging markets and either repatriate those funds back to HQ or hold them locally. To take a typical pay-in transaction, for example, dLocal would enable Uber to receive a payment from a local passenger in Brazil in BRL, process the funds domestically, and then, depending on Uber’s preference, either deposit them into a local bank account (a local-to-local transaction) or exchange them to USD and repatriate them to US HQ (a cross-border transaction). Cross-border transactions represent roughly 2/3rds of total volume, according to recent commentary by management. dLocal also handles withholding tax and income tax management on behalf of merchants.

dLocal originated from and is headquartered in Uruguay, although the team is now distributed across multiple countries. Since inception in 2016 they have rapidly expanded in terms of geographical coverage, support for different payment methods, and additional products. As of Q2 2022, they support over 700 local payment methods across 37 countries and provide value-add services on top of payment processing, such as fraud prevention, tax management, and card/virtual card issuance. Their TPV (total payment volume) has grown very fast. The chart below gives you a sense.

Despite this breadth of products and geographical coverage, dLocal pursues a differentiated go-to-market approach that they call the One dLocal model. They offer merchants one direct API, one contract, and one cloud-based platform. This remains the same no matter how many countries, payment methods and products merchants might want to expand into. Assuming a key part of their value proposition lies in abstracting away complexity for merchants, then the simplicity of this model allows them to achieve that in a frictionless way.

Having originated from Uruguay, dLocal’s business has been concentrated to-date on Latin America, but is now expanding rapidly into Africa and Asia. In Q2 2021, Latam represented 91% of revenue and Africa & Asia represented 9%, but by Q2 2022 Latam was down to 87% of revenue and Africa & Asia up to 13%. This implies very rapid growth in Africa & Asia. This should be expected given a low base but nevertheless is encouraging. The company is also expanding their employee footprint in Africa & Asia and 19% of total FTEs are now based in the region. dLocal’s President, Jacobo Singer, recently relocated to Cape Town in order to head up expansion efforts locally.

One encouraging element of dLocal’s geographical expansion is that their merchants appear to be expanding with them. As of the latest quarter, dLocal’s top ten merchants are using them on average in 9 countries, which is up from 7 a year ago and from 4 in 2018.

dLocal does not pursue local merchants, because a key element of their strategy, as the chart above implies, is to grow not only their product footprint with existing merchants but also their geographical footprint. For that reason they target merchants who do business in multiple countries. Clients include global companies such as Uber, Microsoft, Didi, Tripadvisor, Dropbox and Mailchimp. Revenue concentration has been improving, with the top 10 clients representing 51% of revenue in Q2 2022 compared to 63% in Q2 2021.

They have a merchant base that is relatively well diversified by vertical, albeit still concentrated among the digital economy.

Business Model

dLocal offers merchants a suite of core services, including payment processing, FX management, fund collection, fund settlement and fund disbursement, and also a series of value-add features, including fraud prevention, reports and analytics, regulatory management, compliance management and tax withholding management. They charge a negotiated fee to each merchant per approved transaction either as a fixed fee per transaction or fixed percentage per transaction. The fee mechanics vary by product, market/geography, total payment volume processed, and required functionality (e.g. whether the merchant wants funds settled locally or repatriated).

dLocal’s net take rate, i.e. their revenue minus fees paid to banks, local acquirers, card networks etc divided by total payment volume, is significantly higher than the net take rates of global competitors. In my understanding, this is a function of two things: 1) cross-border transactions (roughly 2/3rds of TPV) include FX conversion fees, which can represent a significant chunk of revenue, and 2) they can levy higher fees for improving authorization rates because local payment processing alternatives offer lower authorization on average than the norm in developed markets.

This data is very approximate but it is estimated that dLocal on average achieves a ~90% authorization rate compared to ~70-75% for local competitors. By comparison, developed market authorization rates would start from a higher base, meaning that a competitor like Adyen would be delivering less relative value to a developed market merchant by achieving a comparable authorization rate. Achieving higher authorization rates is crucial to merchants and overwhelms the impact of a higher take rate. The table below shows two scenarios and illustrates that a 1 percentage point increase in take rate is insignificant for a merchant compared with the revenue improvement delivered by a higher authorization rate.

dLocal does not disclose the exact split between pay-in, pay-out and marketplace transactions, but commented on the most recent quarterly call that pay-in transactions are roughly 75% of TPV and that pay-ins and pay-outs are growing at similar rates. While pay-ins generate a higher gross take rate versus pay-outs, the net economics appear to be similar as pay-ins also incur a higher processing cost.

The above all said, dLocal says often and loudly that they do not manage the business for take rate. They focus on maximizing the absolute dollar revenue and gross profit from each customer by pursuing a “land-and-expand” model similar to most SaaS companies, i.e. they try to acquire customers and over time increase revenue by penetrating more of the customer organization and by layering on additional products/services. In dLocal’s case, this also includes the angle of trying to expand their geographical relationship with customers. Net Revenue Retention (NRR), i.e. revenue growth net of churn in a given period from existing customers only, is therefore the key metric. NRR is more important to watch than revenue from new customers because new customers typically take 3-6 quarters to ramp up, meaning that the upside from the customers acquired this year will mostly reflect in next year’s NRR. Customer churn has historically been very low at less than 1%.

NRR has been growing very rapidly recently but has started to come down as comps get tougher. dLocal is guiding for 150% NRR for 2022, despite achieving 190% and 157% in Q1 and Q2, and this reflects a very strong H2 2021.

Generally speaking, business models in the online payments sector are attractive. Payment processors like dLocal, Adyen, and Stripe are likely to offer durable revenue growth over the medium to long term, driven by the structural transition to online payments from offline, as well as by innovation around different payment methods themselves. Even during the 2008-2009 financial crisis, non-cash payment volume increased by mid single digits. Operating leverage is also inherent to these businesses and acts as a powerful value driver. Assuming they can achieve a sufficient scale, then payment processors can amortize high volume over a largely fixed cost base, creating the potential for very high margins. Coupled with an asset light balance sheet, high margins translate to high free cash flow generation. This cash in turn can be used to fund acquisitions, buybacks, and/or dividends. Scale is key.

The primary issue for merchant acquirers concerns competition and fragmentation. I’ll explore this shortly.

Market Opportunity

Historically payment volumes in emerging markets have been expected to grow faster than in developed markets, reflecting expectations for faster economic growth in emerging markets. The chart below from a Credit Suisse report from 2020 illustrates that card volumes were expected to grow roughly at double the rates of the US and Western Europe over 2019-2023.

I doubt the wider economic outlook is quite so rosy, at least in the short term. Increasing interest rates in the US are likely to create fiscal pressure on emerging markets with significant levels of USD denominated debt and are already leading to widespread financial outflows as capital flocks back to developed markets offering rising yields. For net exporters the current account should receive a boost from higher energy prices, but net importers suffer the inverse. In particular, countries in Sub-Saharan Africa are very exposed to rising food prices, given food consumption represents ~45-60% of household expenditures. Well aware of these dynamics, local central banks are doing their best to hold off inflation and have hiked rates viciously. Interest rates in Brazil, for example, are now at 13.75%, while inflation is 8.7%.

On the other hand, non-cash payment volumes specifically are supported by structural tailwinds. In 2020, total global payments revenue declined 5% according to McKinsey, as a result of Covid-19, but non-cash forms of payment volume actually increased, as illustrated by the charts below from the Bank of International Settlements. Covid caused a rapid acceleration in the digitization of payment flows.

Non-cash payment volumes in emerging markets also benefit from strong adoption of new and innovative payment systems in the region. For example, developing countries have on average been more progressive in their adoption of digital wallets and real time payment systems than most developed markets. India’s instant payment system, UPI, is now doing over 6 billion transactions per month. Brazil’s instant payment system, Pix, having launched in November 2020, is now processing over $180 billion per month in transaction volume.

Regarding mobile wallets, the success of WeChat Pay and AliPay in China has been well-covered, but it is also worth highlighting MercadoPago - the brand-specific wallet launched by MercadoLibre, Latam’s leading marketplace. Other companies are likely to follow suit and launch their own in-app wallet payment methods. NuBank recently launched Nu-tap and ualá in Argentina has already seen explosive growth. Instant payments are also growing in Africa, where mobile wallet payments in Nigeria grew 391% between May 2020 and May 2019. M-PESA, Africa’s largest mobile money platform, grew transaction volume by 33% in 2020.

So with all this in mind, let’s try to put some rough numbers on dLocal’s total addressable market. Americas Market Intelligence (AMI) Research estimates total e-commerce payment volumes in emerging markets ex. China in 2020 to have been $810 billion, which breaks down as $428 billion in pay-in volumes and $382 billion in pay-out volumes. In my understanding this estimate includes both cash and non-cash payment methods (as dLocal also supports cash payments). 86% of pay-in volumes corresponded to local-to-local (i.e. domestic) transactions and 14% corresponded to cross-border transactions. AMI estimates pay-in volumes will grow at a CAGR of 27% until 2024. AMI also forecasts the share of pay-out volumes to increase in the coming years compared to pay-in volumes, reflecting expectations post-Covid for travel, ride hailing and remittances to recover.

For my purposes, I take AMI’s estimates up to 2024 and then extend to 2030 using my own. I forecast total pay-in volumes at a CAGR of 20% from 2024 to 2030, within which category I assume the share of cross-border payments expands by 0.5 percentage points per year from 2021 onwards. I also assume that the share of total pay-outs compared to total pay-ins also expands by 0.5 percentage points per year. Putting all this together, it implies the total e-commerce payment volumes in EM ex. China could reach $7.0 trillion by 2030. For context, Visa and Mastercard combined global volumes totaled $20 trillion in 2021.

The goal of this forecast is not so much to estimate dLocal’s TAM as it is to set up some reasonable context within which to sense check my TPV and revenue assumptions for the company. More on this shortly, but at a high level dLocal’s TPV in 2020 of $2.1 billion implies 0.26% market penetration, which suggests the company ought to be able to grow volumes both as a result of a growing with the market and as a result of increasing share. This is an imprecise exercise, but it gives us enough basis for believing that dLocal has significant potential volume upside ahead.

Competitive Dynamics

On the one hand, merchant acquirers like dLocal have attractive business models and are operating in a market that is large and growing, but, on the other hand, they are exposed to fragmentation and competition. Given the former is already reflected in high multiples, the long-term investment case for dLocal to my mind hinges on the latter.

The key question is not who wins. Payment processing is not and will not be a winner-take-all or winner-take-most market. Network effects do not really apply here, as one merchant does not derive benefit necessarily from another using dLocal or Adyen etc, at least in a direct sense. Barriers to entry are not insurmountable, as evidenced by the number of players in the market. Switching costs do apply, but are perhaps not the moat in isolation they are thought to be, for merchants do reportedly switch payment vendors despite the pain involved. Most importantly, merchants prefer to have multiple payment processors. This allows them to manage the risk of having a single point of failure within their business and also allows them to measure the performance of payment service providers against one another in order to keep pressure on take rates and have leverage in demanding the best execution. There will always be multiple players in payments processing.

The key question for dLocal is rather whether they will be able to grow into and beyond their valuation or whether the growth necessary to achieve that will be competed away.

In theory dLocal competes with both local and global players. Local competitors would include PayU (owned by Naspers) and Ebanx. PayU has been established in Latam for a while now, but lacks a comprehensive offering and also lacks a foothold in Brazil. The largest chunk of their TPV likely comes from India. Ebanx is a private company that, in contrast to PayU, has a decent presence in Brazil but lacks the same strength in the rest of Latam. Their offering also does not have the same breadth of add-on services that dLocal offers.

But local players are not dLocal’s true competitors, because their strategy seeks to target merchants operating across multiple geographies. Instead, they view global players as their true competitors, notably Adyen. I would add Stripe to the mix, given their plans for expansion into EM appear to be stepping up.

Adyen has a different business model to dLocal in that they are a full-stack acquirer, including having their own acquiring licenses in many locations. They also differ from dLocal along a couple of important strategic lines: 1) their refusal to do M&A, and 2) their refusal to customize their product offering for merchants. The most significant difference is geographic, as they are focused above all on Europe and on expanding in the US. That said, they work with with many of the same merchants as dLocal and the importance of distribution in the payments market will always make them a competitive threat.

Adyen has had a presence in Brazil and Mexico (but not in Africa) throughout dLocal’s history as a company and dLocal has managed to outcompete them. dLocal has a more localized solution that is more deeply integrated with better reach across different payment methods and different regulatory environments, which leads to better fraud prevention and better conversion rates. Emerging markets do not appear to command the same level of focus for Adyen’s management team. Instead they appear focused on their dominant position in Europe and on their expansion in the US.

In his write-up on dLocal last December, Jonah Lupton included a great quote from the former global lead of local payment methods at Facebook/Meta that illustrates the difference between dLocal and Adyen as things stand today. Reproducing below:

We did use Adyen, and they were just not strong in Latin America. They did not have the soft-touch personal relationship-building skill that dLocal did have. They were not able to accompany the expansion.

You have to understand one thing…when you’re sitting in one of these roles at these big global companies, you’re trying to show that you have a handle on a region. Therefore, an Adyen that says, “The only thing I can do for you in Latin America is is one method in one big country,” is pretty useless compared to a company that has its roots in the region.

This picture is not immune to change, however, and in theory there is nothing to stop Adyen choosing to prioritize EM in a way that they have not historically.

Stripe is in the early days of expanding into emerging markets, but is doing so aggressively. Their top international expansion priorities are Southeast Asia, Latam and Africa. The focus for now appears to be on Southeast Asia, where mobile internet users are highly engaged. The number of mobile internet users in the region increased by 100 million over 2015 to 2020, according to estimates by Google and Temasek. Stripe is running its operations in the region out of Singapore. As far as Latam goes, Stripe launched in Mexico in 2019 and is already working with a few leading companies in the region, such as Rappi.

Any enduring competitive advantage dLocal may have against global peers, to my mind, stems a) from their continued singular concentration on emerging markets and b) from their comparatively unique approach to growing NRR, which relies not only on deeper product penetration of a customer organization, but also on penetration into a customer’s geographic footprint.

When trying to land a new global merchant who wants to accept and make payments in EM, dLocal can demonstrate local knowledge, integration with a broad range of local payment methods, the ability to manage FX and cross-border transactions as well as the ability to handle local transactions, knowledge of and compliance with local regulation and compliance, and, ultimately, superior performance via better authorization rates.

But their model deepens from here as they grow TPV with merchants across multiple countries and continents, in addition to layering on additional products. Each country they expand into with a merchant involves a new set of payment methods, a new set of local regulations, new fraud and conversion dynamics, and another currency. Given their one API model, expansion would seem frictionless to a merchant even though complexity under the hood has increased in a non-linear fashion. This in turn increases the value delivered to customers in a non-linear fashion and increases the difficulty any competitor would experience in trying to replicate dLocal’s offering. The effect is to take two strategic aspects of payment processing as a whole, switching costs and barriers to entry, and to make them more salient. At the same time, the growing geographic breadth of dLocal’s offering succeeds in making them more appealing to new merchants.

The power of their model shows up in their annual cohort performance, per the chart below:

As another illustration, dLocal at one point provided a case study that showed a how a merchant they initially partnered with in 2018 had by Q3 2021 grown TPV 30x, expanded to 9 countries and increased required support up to 109 payment methods. The depth and complexity of a customer relationship like this strikes me as very defensible.

That all said, even if we accept that dLocal has and will continue to have the superior solution in emerging markets, increasing efforts by Adyen, Stripe and others to increase their foothold should put pressure on take rates, all else equal. I think the market understands this. Management knows this too, which is why they insist they manage the business to maximize absolute dollar revenue and operating profit and not to maximize take rate.

One other dynamic to mention when considering competition in the payments space going forward is that it is becoming a truism that being a pure payments processor is no longer enough. The core elements, such as scale and having strong customer relationships, are still crucial of course, but payments have now become embedded into the end-to-end customer purchase-to-pay journey as a result of the increasing digitization of commerce. This means that merchants are starting to look for solutions that provide not just discrete payment execution, but also facilitation of commerce itself. For example, you could (should?) look at buy-now-pay-later solutions this way, i.e. less as a new lending model and more as a payment method that drives higher checkout conversion. McKinsey estimates that 40% of merchant acquirer revenues by 2026 could come from activities other than payment processing. This might potentially exacerbate competition in the sense that larger companies could use ancillary businesses to subsidize take rates on their core payment processing. The companies are well aware of this dynamic and for this reason offer a host of add-on services. dLocal offers fraud prevention, card issuance, tax management, analytics and so on, while Stripe and Adyen have built out their own suites of adjacent services.

Financials

My approach to forecasting revenue for dLocal is to make explicit assumptions around likely future net revenue retention and revenue growth from newly acquired clients. I also assume a trajectory for take rate, from which I infer TPV. I then look at what my forecasted TPV implies in terms of market share. You can find a copy of my model here.

I assume that dLocal hits their 150% NRR guidance in 2022 and that thereafter NRR declines gradually to 115% by 2030. I assume 15% revenue growth from new merchants in 2022, declining gradually to 5% by 2030. The below chart illustrates the trajectory for both.

Obviously these are rough forecasts, but my benchmark when thinking about a reasonable future NRR for dLocal is to think about the overall median and average net revenue retention for listed SaaS companies. Most recently these clocked in at 120% and 119% respectively. In other words I am assuming that dLocal’s NRR declines from recent rapid expansion to a level somewhat below the average for listed SaaS peers today. Arguably, I think the company could perform better than this. While emerging market economies may face a torrid time over the next year or so, the structural potential for e-commerce payment growth in the region remains huge. dLocal’s penetration of large enterprises is also still modest and I have already outlined how powerful I think their geographic-oriented NRR expansion model can be. But I prefer not to be overly aggressive with my forecasts. The share of revenue growth from new customers should go down over time as dLocal gets bigger and, as I mentioned earlier, will never be huge given the lead time for customers to ramp up.

I assume that dLocal’s net take rate declines from 2.26% in 2021 to 1.38% by 2030. This is for two reasons. First, I do assume that competition will put pressure on take rates and that competition in EM will increase. Even if dLocal is able to prove out a superior solution against competitors, large merchants are still likely to work with 1-2 other payment processors and use this to pressure take rates over time. At 1.38%, dLocal would have a net take rate comparable to Block’s today (which by 2030 will probably be lower). Second, there is an inverse relationship between take rate and TPV growth. As dLocal expands into new countries and tries to win new business, they are likely to trade take rate for volume. The CFO confirmed as much during the Q2 2021 conference call by mentioning that they do not start at an “optimal level of gross profit” when launching new countries.

From my revenue and take rate assumptions I derive an implied TPV forecast out to 2030. This suggests that dLocal grows total payment volume market share within EM ex. China from 0.26% in 2020 to 1.74% by 2030 and that, within pay-ins only, they grow share from 0.37% in 2020 to 2.72% by 2030. This seems reasonable.

The way dLocal reports gross profit is similar to what companies like Adyen disclose as net revenue, i.e. the largest component of cost of goods sold is payment processing costs and this is factored into net yield. Other costs of goods sold include hosting, amortization of intangibles and salaries for operations personnel. Overall I expect gross margin to be lower over the next 2-3 years, reflecting investment in expansion to new countries, before recovering to 2021 levels gradually by 2030 as the benefits of scale kick in. I forecast all operating expenses going forward as a flat percentage of revenue.

All-in-all, despite having grown extremely quickly over recent years, dLocal achieved an EBITDA margin on net revenue in 2021 of 65%, slightly better than Adyen, which achieved a 63% EBITDA margin in 2021. Net margin in 2021 was 32% and I expect it to average 29% over 2022-2030. It is unusual to find a company growing so rapidly and yet maintaining such high levels of profitability, which serves to reiterate my earlier point about the power of the operating leverage inherent to the payment processor business model.

dLocal is also highly capital efficient and on my estimates converts 70-80% of EBITDA to free cash flow. It is worth clarifying here that when calculating free cash flow it is necessary to strip trade receivables and trade payables out of net working capital, as these mostly reflect amounts received from/paid to merchants and are in effect restricted. As such they should not be included in net investments into the business.

I also estimate that dLocal generates very high returns on invested capital. If I calculate ROIC on an all-in basis, i.e. without stripping out excess cash and without adjusting working capital for receivables and payables, then dLocal generated a 49% ROIC in 2021 and over 2022-2030 will average a 35% ROIC, reflecting my expectations for them to invest in expansion and for take rate to decline, as well as the build up of cash on the balance sheet. Even so, this is an attractive level of returns. However, if I adjust my invested capital calculation by stripping out excess cash and by removing trade receivables and trade payables from net working capital, then I estimate underlying ROIC to be ~175% in 2022 and to grow to well north of 200% by 2030. This is a better approximation of the underlying returns of the business, which are extremely high. This is driven not only by high margins, but also by high capital turnover (defined as revenue / invested capital). I estimate that capital turnover will average 8x over 2022-2030. The way to think about this is that because dLocal is an asset-light business, it takes a small amount amount of invested capital to generate a unit of revenue.

One last thing to mention is that, in order to avoid too much cash building on the Balance Sheet, I assume that in future years dLocal starts to deploy excess cash to buybacks and dividends. They could spend instead on acquisitions and have done in the past. In March 2021 they acquired certain assets of PrimeiroPay, another Latin America focused payment service provider, for $40 million. Management has since signaled willingness to do further M&A in order to aid growth, but has clarified that these are likely to be smaller, bolt-on deals versus blockbuster efforts.

Valuation

My main approach to valuing dLocal is to estimate intrinsic value using a DCF. I estimate a 12.8% WACC using the parameters below:

I project free cash flow discretely through FY 2030 and thereafter estimate continuing value using a 5% long-term growth rate. Discounting this all back to today, I end up with an intrinsic value per share of $24.95, representing 2.7% upside from the current price as of the time of writing (on 09/21/22).

I cross-checked this by calculating the theoretical IRR for an exit in FY 2030. If I use a a Price/FCF multiple of 30x on FY 2030 free cash flow, then I get an exit value per share of $63. Buying the stock today (09/21/22) and selling the stock in eight years for that amount, as well as receiving the dividends in between, yields an IRR of 13.2%, just above the company’s cost of capital.

So despite an excellent growth profile and stellar business model, dLocal does not seem too attractive at the moment given the effect of higher interest rates on discounted future cash flows. A 2% risk free rate, for example, would imply 30% upside under my forecasts. Versions of this same story are presently playing out for growth stocks all over. The below chart illustrates this by showing how dLocal shares have broadly tracked the Nasdaq year-to-date.

The below tables show comparative valuation, using consensus estimates sourced from atom finance. On average, dLocal is trading at a discount to its peer group on EV/EBITDA and P/E multiples, reflecting high margins, but at a premium for EV/Revenue. It offers better returns than most peers, as measured by Return on Equity. In general, dLocal appears more attractively valued than its main competitor Adyen, but this isn’t saying much given how expensive Adyen is.