Investment Memo: Intuit ($INTU)

A capital efficient company with a decent growth story, but I am somewhat cautious on valuation

Financial markets have had a tough time recently. We face political challenges on a scale not seen in the West since World War II and severe economic challenges. The Federal Reserve is now well into an interest rate hiking cycle and most major equity indices have declined significantly year-to-date. Publicly listed tech stocks have de-rated brutally, while in private markets we’re now seeing plenty of confirmation that “the funding slowdown is real”. Perhaps at long last people are asking themselves whether the era of free money that has defined the financial economy, and indirectly also the real economy, over the past twelve years is coming to an end. Or, based on the rally over the past month, perhaps they’re not?

Regardless, it is times of uncertainty like these that can be the most rewarding for an investor. So I have started to do more research on individual investments for my own portfolio and I thought it would be good practice to write up and publish my work. Today’s post is on Intuit ($INTU).

As an aside, I decided not to spin these equity research memos out into a separate publication, but rather to keep everything under my existing newsletter. The reason is that I don’t have any clear mental delineation between my areas of interest in life. I read a lot of literature and philosophy, am currently going down an economic history rabbit hole, am fascinated by technology, and love investing. But I don’t view these things separately. They are part of one unified range of stuff that I find interesting. I want this blog to try to reflect that.

Finally, it goes without saying, but none of this is investment advice. This is just me putting my thoughts down on paper.

Investment Conclusion

My original motivation for looking at Intuit was the idea that the company’s two main businesses - bookkeeping and filing tax returns - could be defensive during times of economic stress, given there remains a non-negligible chance that we head into a recession in the US at some point over the next 6-12 months. I think there is still merit to this angle, but my investment view has been determined more by the long-term growth outlook.

Intuit operates two category defining products in QuickBooks and TurboTax, both of which maintain a strong share of their respective markets. The company is now striving to unlock the next phase of revenue growth by expanding human-assisted versions of their products. In the case of QuickBooks, this means the ability for a company to have live support from a CPA/expert in managing their books, while, in the case of TurboTax, this means having a CPA/expert assisting you file your tax returns or even doing it for you. These initiatives have the potential to expand volume via unlocking a larger addressable market and also expand blended ARPU given assisted products can demand a higher price point. In addition to this, the recent acquisitions of Mailchimp and Credit Karma have the potential to supplement growth and drive synergies with both QuickBooks and TurboTax. Overall, Intuit is trying to become less a bookkeeping and tax solution and more a single platform for the financial management and health of businesses and consumers.

I believe Intuit should be able to achieve some success in pursuing this strategy, but I also believe greater competition is inherent to any attempt to expand share of the customer value pie beyond the initial wedge. As Jim Barksdale famously said, you can make money bundling and unbundling. Many fintechs and SaaS companies are now trying to bundle, having first unbundled, and pursue the holy grail of being the “super-app” for a consumer or “source of truth” for a business. I think such competition is likely to constrain growth. For that reason, I am more conservative in my revenue growth forecasts compared to what Intuit believes is achievable.

My valuation model does not currently yield an intrinsic value for Intuit that is overly compelling, but this is more a result of where interest rates are trading than of my relatively conservative revenue forecasts. The stock could still outperform should the company achieve their long-term guidance, but to me this implies near-perfect execution is required. One other consideration is that this might also be a stock on which the market places a premium in the current environment owing to its quality and, as mentioned above, owing to the defensive nature of its core business lines.

Erring on the side of caution, Intuit is a stock I will watch for the time being. But I will use any valuation pull back to build a position. In the near-term, there is also the question of interest rates and how any sense that these start to come down would affect the valuation. If the market does start to build conviction that the worst of inflation is behind us and that rates will come down, then Intuit will outperform. Trying to predict when this could be, however, is not something I plan to attempt.

In the main body of the post below, I give a brief overview of what Intuit does before diving into each of the company’s three main segments in more detail. I finish by discussing my financial forecast and valuation.

Please do hit me up in the comments with any feedback or pushback. And do let me know if you think I’ve got something plain wrong.

Company Overview

In a nutshell:

Intuit is a company that primarily provides software-based solutions for completing the boring but crucial aspects of financial management that most people and businesses would love to avoid, but must in fact treat very seriously.

In more detail:

Intuit provides financial management and compliance products for consumers, small businesses, and accounting professionals mostly in the United States and Canada, but also internationally. The company has four business segments: Small Business & Self-Employed, Consumer, Credit Karma, and ProConnect.

The Small Business & Self-Employed segment provides accounting solutions to small and medium sized businesses and self-employed professionals via the company’s flagship Quickbooks product. Quickbooks Online (QBO) is the main cloud-based version of the product that allows customers to track expenses, income, invoices, estimates and pay bills, both from a computer as well as a mobile phone. More advanced functionality includes business reports, analytics and financial reports. Also now included is a Live offering, where customers can talk directly to an accountant to assist in their bookkeeping and planning. Quickbooks Online is the fastest growing product line within the Small Business segment. Intuit also still offers Quickbooks Desktop - the legacy downloadable version of the product for customers who were already on the platform and do not want to switch to the online version yet. This should become a small minority of units over the coming years. Intuit also offers customers online payroll solutions, which customers can purchase as an add-on to Quickbooks or as a stand-alone, and online payment solutions for electronic payment processing either via card readers whose data can be inputted into Quickbooks or in an integrated way as part of the company’s mobile applications.

In November 2021 Intuit took steps toward further broadening the service capability of the Small Business segment by acquiring Mailchimp for $12 billion (roughly 50/50 cash vs stock). Mailchimp is a customer engagement and marketing platform that helps grow small and mid-market businesses. It brings audience data, marketing channels, and actionable insights together on a single platform, offering marketing CRM tools, automated messages, insights and analytics, as well as a content studio with design tools, templates, and an AI-powered Creative Assistant.

The Consumer segment provides TurboTax income tax preparation products and services and also personal finance support via the Mint app. TurboxTax has traditionally targeted the DIY tax preparation market, but is now also going after the larger assisted tax prep market via TurboTax Live, a version of the product that allows a customer to talk directly to a CPA who will guide them through filing their taxes.

Credit Karma, which Intuit acquired in December 2020 for $8.1 billion (42% cash / 58% stock), offers consumers a personal finance platform that provides personalized recommendations for home, auto, and personal loans, as well as for credit cards and insurance products. It also offers a high yield savings account.

The ProConnect segment is comparatively small and delivers a cloud-based tax preparation software solution aimed at professional accountants (either individuals or firms), who prepare moderately complex consumer and small business tax returns.

Small Business & Self-Employed

Product and Market Overview

The Small Business & Self-Employed segment represented 49% of total revenue in FY 2021 and 48% of total segment operating income. After the recent addition of Mailchimp, I forecast this segment will represent 51% of revenue in FY 2022.

As mentioned above, the segment’s main product is QuickBooks, a bookkeeping software solution aimed at small businesses and self-employed professionals. The company splits this out into two broad buckets: Online and Desktop. An online version of QuickBooks has been around since 1998, but it did not really take off until it was overhauled in Spring 2014. QuickBooks Online (QBO) was essentially rebuilt and made compatible across multiple platforms and devices as part of an aggressive transition to the cloud. Now QBO represents 59% of SB&SE segment revenue. The Desktop version is not really growing any more (an average 3% annually over the past four years), but existing users appear to be sticky. The vast majority of future revenue growth for the segment is expected to come from QBO.

QuickBooks Online offers most essential bookkeeping features that a small business would require and has four different pricing plans. The higher price points reflect the number of users and additional features to manage greater business complexity. The Advanced version is aimed more at mid-market customers.

There is also a version of QuickBooks Online that is aimed at Self-Employed professionals. This version offers one main pricing tier and two additional plans that are bundled with TurboTax/TurboTax Live.

Finally, Intuit is also moving into the assisted bookkeeping market with QuickBooks Live, a version that allows a customer to connect with a live accounting expert who offers a comprehensive overhaul of a company’s books and records and will act as a regular point of contact going forward. By offering contact with a live expert Intuit hopes to convert more SMBs who have not yet adopted a software-based solution for their bookkeeping. QB Live is offered at a higher price point of $200/month.

Historically QuickBooks has been aimed at small businesses with roughly 1 to 10 employees, but has begun to move both down and up market. QuickBooks Self-Employed is aimed at self-employed professionals and independent contractors, while QuickBooks advanced is going after mid-market customers (roughly defined by the US Small Business Association as having more than 500 employees).

In their latest investor presentation, Intuit defines their total addressable market (TAM) for the Small Business & Self-Employed segment across their four core markets (USA, Canada, UK & Australia) as 73 million SMBs and SEs and 2 million mid-market customers. Based on data I could piece together on the number of small businesses in Intuit’s core markets, the TAM breaks down as follows:

In any given year there are almost as many small company deaths as births, so for simplicity I assume that the segment TAM will stay the same going forward.

In USD terms, Intuit estimates their TAM as $41 billion for US bookkeeping software, $78 billion for US connected services (i.e. payments, payroll etc), and $30 billion for international bookkeeping and connected services. They also estimate that Mailchimp adds an incremental $30 billion TAM.

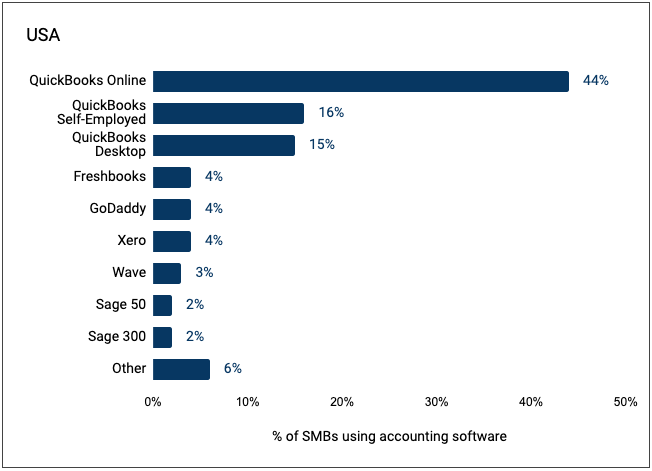

Within its target client segment, QuickBooks is the clear market leader in the US and Canada, holds a decent second place in the UK, but is still relatively small in Australia. I found precise market share data difficult to pin down, but I was able to source some estimates that are compiled based on numbers from public sources and customer surveys. The charts below show a breakdown of market share by accounting software for each of QuickBooks’ four core markets.

One thing these charts illustrate well is that QuickBooks Desktop maintains a stubborn share of businesses in all markets except for Australia & NZ, where QuickBooks overall does not yet have a strong position.

It is important to remember, however, that this market share data, while indicative of the quality of the product, does not inform so much the growth outlook for QuickBooks. Intuit expects most future customer growth to come not from taking share from competitors, but rather from converting businesses to a digital bookkeeping solution from a manual approach. Various estimates have implied roughly half of US small businesses are using some kind of accounting software, but in my understanding a decent amount of this actually could mean Excel. Intuit estimates that 84% of small businesses use pen and paper or spreadsheets for more complex tasks like reconciling inventory. This leaves a large remaining opportunity to convert these businesses to a true software solution.

Capturing share from competitors is also a tough proposition owing to the high switching costs inherent to a bookkeeping product. Once a customer has used a product for any decent length of time, it is likely to be deeply integrated into the business’ transaction and record data to a point where an alternative solution would need to offer significant incremental value to mitigate the pain of switching. You’ll notice from the charts above, for example, that Xero, which is the definitive market leader in Aus/NZ, has struggled to make progress in the US market and not for lack of trying.

The flip side of high existing customer retention though is that the battle to land the initial customer is crucial and therefore aggressive. Evidence of this is supplied by the screenshots above showing 50% discounts on initial periods - discounts on price points that already seem cheap.

Strategy

The key element of Intuit’s strategy for the Small Business & Self-Employed segment is that they want to move away from being known as an accounting solution towards becoming the source of truth in helping a customer understand and run their business. Part of this strategy exists in the form of the add-on services customers can adopt on top of QuickBooks, including payments, capital, full-service payroll, time tracking and commerce. In the past, Intuit has experimented with how to position these products, at one time trying to use payments as a front door to QuickBooks. This did not catch on and so these products are now firmly positioned as add-ons.

The most ambitious expression of this strategy, however, comes in the form of the recent acquisition of Mailchimp for $12 billion. Mailchimp is a customer engagement and marketing platform that helps grow small and mid-market businesses and it has the potential to generate decent synergies. Mailchimp does more than email marketing, it brings audience data, marketing channels, and actionable insights together on a single platform. Customers can launch websites and utilize built-in marketing tools, as well as make use of marketing CRM tools, automated messages, insights and analytics, a content studio with design tools, templates, and an AI-powered Creative Assistant.

At a recent conference, I think the CEO gave a cogent explanation for why the acquisition made sense, so I’ll quote it here (emphasis mine):

We started studying and really learning from our customers. And what we realized is they had created like 4 billion records in QuickBooks. And when we started following up with customers, what we realized is they're trying to use QuickBooks as a CRM tool. And when we ask, "Why are you doing this within QuickBooks? There's other CRM tools out there." The predominant answer was all my transactional data is in QuickBooks. I need my customer list and CRM capabilities right here because I can manage my business. And that's really what led to we really need to have this be part of the QuickBooks platform. And really the essence of the answer to your question is this is not about cross-sell, this is all about product. So our product strategy is to integrate all of the Mailchimp and QuickBooks capabilities so that if you're a small business and you're in QuickBooks and you want to find a way to grow your business, you can leverage all the capabilities of Mailchimp to be able to market to your existing customers, to be able to go after new prospects because all the Mailchimp capabilities are right built into QuickBooks and then vice versa. If you're in Mailchimp and you are marketing to your existing customers or trying to get new prospects, all of our payment capabilities, payroll capabilities are all integrated. So this is all about integration on the product side.

Despite what the CEO says here, there has to be upside in the short term from cross-selling QuickBooks to Mailchimp customers and vice-versa, but in the long term I accept that this really is about strengthening the product in such a way as to address a broader range of customer needs, thereby tightening retention and providing a deeper value proposition. Prima facie, I buy this. It should contribute on balance to growth in new customers and blended ARPC over time.

The main issue I see with the strategy in general terms is that it is a crowded one. Most fintechs pursue a strategy along similar lines, i.e. acquire customers with a differentiated initial product and then over time layer on top additional value-added services. Stripe, for example, is using payments as their initial hook and then offering similar add-on services like capital, invoicing and billing etc. Similarly Block (fka Square) starts with point-of-sale software and then tries to layer on invoicing, banking, payroll etc. So one could raise the concern that while each of these companies finds a different wedge into the customer pie, they converge upon competition with one another as they try to take larger pieces of it. In other words, Intuit could be trying to expand their potential share of the pie, but in the process exposing themselves to increased competition.

The key question is which initial product wedge has the best chance of acting as the centre of expansion. Is it payments? Bookkeeping? Data linking? I honestly do not know, but I can imagine an argument in QuickBooks’ favour that accounting is serious enough to be a solid foundation on top of which customers layer more products. It is also deeply embedded into the transactional plumbing of a business. I can also imagine a counterargument that accounting is not something most operators like to spend a lot of time thinking about.

I think the main thing Intuit has going for its expansion efforts is its Lean Startup style obsession with customer focus and constant product iteration and optimization, dating back to the culture of experimentation that Scott Cook originally put in place. Such iteration and optimization is further underpinned by the data Intuit can accumulate via QuickBooks, as this gives them a granular understanding of their customers’ businesses.

Outlook

Management is targeting revenue growth for the online ecosystem of 30% per year, coming from 10-20% new customer growth per year and 10-20% annual ARPC expansion.

In my forecast I try to split out QuickBooks Advanced and project it separately, as this product iteration is going after a different customer segment. I assume it can average 17% annual customer growth over FY 2022 - FY 2030, which would imply it goes from 6% penetration of its target customer market in FY 2021 to 23% by FY 2030. This strikes me as reasonable. I assume only a modest 2% annual growth in ARPC, as one of the value propositions of this product for the mid-market is its attractive price point (~$2K per year vs peers at $10-25K per year).

For the rest of QuickBooks Online I project annual average customer growth over FY 2022 - FY 2030 of 12%, starting higher and declining in outer years. According to Intuit’s most recent disclosure for FY 2021, it has 7 million small business QuickBooks customers, implying 14% market penetration of its TAM of 42 million small businesses. By contrast I estimate penetration of the Self-Employed market is a lot lower at around 3%. So this still leaves room for decent growth in the small business market, but for greater growth in self-employed. My forecast implies that Intuit’s blended penetration of the small business & self-employed market goes from 9% in FY 2021 to 26% by FY 2030. I project ARPC as inflating at 10% annually. My implicit assumptions here are that they will be able to drive ARPC expansion as a result of a low current base, the higher priced QB Live and QB Advanced products, and the contribution from add-on services. But I also expect a counterweight on price growth as a result of competition in add-on services and from mix effects, given I believe we will see stronger customer growth from lower-priced self-employed customers.

For Mailchimp I forecast 16% average growth per year in new customers over FY 2023 - FY 2030, reflecting the fact that Intuit plans to deploy marketing dollars behind the product - something Mailchimp has historically been abstemious about. I also assume ~4% annual ARPC expansion over the same period.

Putting all this together, I end up somewhat below management’s 30% annual growth target for the online ecosystem at an average 22% per year over FY 2023 to FY 2030 (starting higher at 27% in FY 2023 and declining to 19% by FY 2030). For the Desktop ecosystem I forecast 2% annual growth going forward.

Consumer

Product and Market Overview

The Consumer segment represented 37% of net revenue in FY 2021, but 42% of segment operating income. After the addition of Mailchimp, I estimate Consumer will represent 31% of net revenue in FY 2022. It is worth mentioning that Consumer segment is revenue is highly seasonal and is concentrated in fiscal Q3 (i.e. the quarter ending April), reflecting the annual US tax filing deadline.

The flagship product of this segment is TurboTax, a consumer-facing software solution that helps individuals file their Federal and State US tax returns. To anyone who isn’t a US citizen or US resident for tax purposes, it might seem strange that a multi-billion dollar business could form around what should be a straight-forward civic duty. But once confronted with the byzantine user experience of filing US taxes manually, any lay person would immediately see the value in an intuitive interface that abstracts away that nightmare.

TurboTax has traditionally targeted individuals wishing to file their taxes themselves with the aid of software. Price points range from a simple free version (these represented 35% of total TurboTax units in FY 2021) to a version for Self-Employed individuals.

Intuit focused purely on the DIY market until 2017, when it released TurboTax Live (TTL) - a version of the product that offers advice and a final review from a tax expert. This aimed to unlock the Assisted tax preparation market and convert those who lacked the confidence to file taxes themselves. They followed this in 2020 with TurboTax Live Full Service, which allows a customer to delegate the entire filing process to an expert. Similar to the flagship DIY product, both TTL and TTL Full Service offer a range of price plans. These increase with complexity but most plans compared favorably with the rough industry average price per an assisted filing of ~$250.

The size of the tax return market can be measured in terms of the number of individual IRS tax returns filed in any given fiscal year. In FY 2021 there were 168 million individual income tax returns, of which TurboTax units numbered 49 million, i.e. 29% market share. The market breaks down further into three main categories: assisted, DIY, and manual. Roughly 87 million filings are assisted (53% of the total), 75 million are DIY (45% of total), and 1 million are manual (~2% of total). I assume Turbo Tax Live filings represented roughly 11% of total TT filings in FY 2021, implying that TurboTax had a 57% share of the DIY market and only 6% of the assisted market. However, as a result of much higher ARPUs, Intuit estimates its dollar TAM in the assisted market to be $20 billion, compared to $4 billion for the DIY market.

Some popular competitors include H&R Block, Jackson Hewitt and Tax Slayer. Intuit has taken share from these over the last few years.

Strategy

People often point to a large regulatory overhang for the Consumer segment in the form of tax simplification in the US. If we were talking about another country, I might agree, but in the US it strikes me that there are too many vested interests for such reform to become likely any time soon. There are also some legitimate complications associated with reform, such as the fact that revamping the tax system could result in single parents (temporarily) missing out on tax breaks such as the Child Tax Credit or in low income families missing out on the Earned Income Tax Credit. So, while I don’t want to appear overly sanguine, the risk of major tax reform strikes me as low for now.

TurboTax shares a similar dynamic to Quickbooks in the sense that customer retention is high once you get past the first year, as very few people want to go through the rigmarole of re-uploading their tax information with another provider. This again implies aggressive competition for the first customer. TurboTax and competitors effectively pursue a freemium strategy where they focus on landing a customer with a free/low offering and then try to upsell in later years. Roughly 35% of TT filings in the last two years have been free. When you consider this alongside the same dynamic for QuickBooks, it is not hard to see why the company overall has consistently spent around 27% of revenue on sales and marketing.

But this is also where Intuit’s fanatical focus on customer obsession, product experimentation and iteration, rigorous A/B testing etc is a competitive advantage. As David Kim from scuttleblurb pointed out in a blog post several years ago, in a competitive battle to acquire new customers, getting the small stuff right really matters. For example, by removing friction from the early stages of the funnel, such as requiring your wife and kids’ social security numbers upfront, Intuit can reduce the drop out rate. Small improvements like this are particularly significant when you’re operating from a position of dominant market share.

The company believes that the upside for the Consumer segment will come primarily from capturing share of the assisted market via TTL and TTL Full Service. Since the ARPU on assisted returns is roughly ~4x that of DIY returns (~$232 vs ~$58), even a modest mix increase toward TTL filings should lead to blended ARPU expansion. Intuit does stand a decent chance of capturing share in the assisted market, to my mind, as TTL offers a high quality software-driven experience at a competitive price compared to most traditional CPA/Pro offerings.

Outlook

The IRS discloses an annual forecast for total tax return filings, the most recent of which was published last September. The pandemic caused an uptick in tax returns filed in 2020 and 2021, as a result of the extended tax season and fiscal stimulus measures such as the Child Tax credit that families received via their federal tax refund. The IRS expects some of this to unwind and has total individual income tax returns declining from 168 million in FY 2021 to 161 million in FY 2022, thereafter rising back to 172 million only by FY 2028.

In this context I assume total TurboTax units continue to grow modestly each year and that share of total IRS units expands from 29% in FY 2021 to 38% by FY 2030. I also assume that TTL manages to capture some share of the assisted market and that blended ARPU expands from $73 in FY 2021 to $116 by FY 2030, or annualized growth of ~5%.

Putting this together I have Consumer segment revenue growing in high single digits over the next eight years.

Credit Karma

Product and Market Overview

Credit Karma, which Intuit acquired in December 2020 for $8.1 billion, offers a variety of consumer financial products to its members. They work with two of the three main credit bureaus, Equifax and TransUnion, in order to provide their members with an easy, intuitive way to check their credit scores and key drivers thereof. Based on a member’s score and profile, Credit Karma then displays personalized offers and recommendations to help them make their next financial move. These offers tend to be concentrated around debt products such as credit cards and loans, but they also offer a high yield savings account.

Credit Karma is free for members and instead receives a fee from the underlying financial institution if a user follows one of their recommendations through to completion. For example, if the app recommends I get a Chase credit card and I decide to apply and am approved, Credit Karma will receive a fee from Chase. The value of the product to financial institutions lies in the route to more targeted customer acquisition. Deutsche Bank estimates US financial institutions spend ~$50 billion annually on customer acquisition, so being able to improve bang for buck here could be very meaningful. Credit Karma helps them to target customers based on a full picture of credit and verified income and as a result improves conversion. The product’s proprietary decisioning platform called Lightbox improves efficiency and matching, leading to approval rates above 90%, which is much higher than industry norms. Lightbox combines credit and asset data from Credit Karma, now alongside verified income and cash flow data from Intuit, to provide a holistic view of the consumer. This helps them connect the consumer with the most appropriate financial products for which they are eligible. Credit Karma also gives financial institutions the opportunity to tap into younger demographics, given 50% of members are millennials.

The TAM is theoretically very large, estimated by Intuit at $85 billion, and can be broken down into different product groupings.

Strategy

The main element of the strategy for Credit Karma going forward is integration with TurboTax and QuickBooks in order to drive synergies. There has been a boost in cross-product adoption and engagement in the year and a half since the acquisition. Intuit drove 40% of CK new customer acquisitions in Q1 FY 2022, a significant acceleration of new member growth, and ~38m TurboTax filers were offered access to their tax refund three days early on the basis they deposited it into a Credit Karma Money account. The company also integrated CK Money with QuickBooks Payroll, resulting in 16 million employees depositing $232 billion in payroll volume into CK Money accounts.

These synergies have contributed to the rapid growth Credit Karma has experienced in FY 2022. I expect the pace of growth to slow down in the short term, but in the long-term there does seem to be a viable two-way engagement mechanism between Credit Karma and the rest of Intuit, especially with the Consumer side. This mechanism is underpinned by the data which each side provides to the other, as this deepens the quality of machine-learning predictions on both CK and TurboTax, which in turn should help drive more engagement and so on and so forth. Credit Karma now boasts over 55,000 tax and finance attributes per customer and there are 35 billion daily machine-learning predictions on their AI platform.

Outlook

Intuit’s CEO at a recent conference described Credit Karma as being in “hyper growth” in FY 2022. As discussed above, part of this is related to the synergies post acquisition, but a good deal is also a result of greater user activity. The company saw a high volume of loan originations in 2021 compared to pre-Covid levels and expected this to decline toward pre-Covid levels over time. But as of March 2022 they were still seeing originations going strong. As a result of both of these factors, I am estimating 62% YoY organic revenue growth for Credit Karma in FY 2022.

I expect the contribution from synergies to taper off in the short-term, but I also expect user activity to decline over the next year or so as a result of macro headwinds. It remains an open question whether or not we will experience a recession (one I won’t discuss here), but suffice it to say that a period of above average loan originations in a low interest rate environment followed immediately by a rapid rise in interest rates does not seem to me like a scenario in which monthly user activity continues full steam ahead. It would be prudent to expect some decline in activity.

Intuit believes they can deliver 20-25% annual revenue growth for this segment over the long-term, driven by 4-6% annual growth in members, 6-8% average annual growth in MAUs, and 10-15% annual growth in revenue per MAU. Reflecting the macro uncertainty alluded to above, I estimate only 4% MAU growth and 2% revenue per MAU growth in FY 2023. Thereafter, I estimate both grow in line with guidance, but toward the bottom end. This leaves me expecting only 18% annual revenue growth from FY 2024 onwards.

Financials

In this section I will briefly run through my financial forecast for Intuit and some of the key assumptions. My model can be found here. If you want to edit it and play around with some of the assumptions, then you’ll need to make a copy.

Putting together my key segment revenue forecasts, as outlined above, and assuming some modest growth for the Pro Connect segment, I end up forecasting mid-teens revenue growth from FY 2023 through FY 2030. Revenue growth in FY 2022 will be around 30% YoY owing to the addition of Mailchimp and the Credit Karma synergies on top of the organic growth in the rest of the business.

Gross margin has averaged 83% over the last 5 years and I assume it stays at that level going forward. On the one hand, you could imagine pressure on gross margin as a result of the human involvement Intuit is introducing into the delivery of their product, i.e. CPAs for TurboTax Live and QuickBooks Live, but on the other hand we haven’t seen evidence of this yet and if Intuit is successful in expanding ARPU/ARPC across its main segments then this revenue growth would be higher margin. So for simplicity, I just assume a flat 83%. I model operating expenses as a percentage of revenue and keep these percentage metrics flat going forward, as recent history as shown them to be fairly steady.

I ignore adjusted EBITDA as reported by the company, as this adds back stock-based comp, and instead calculate EBITDA the old-fashioned way by adding back, you know, depreciation and amortization. I don’t want to launch into a big discussion on this subject here, but I will say that I view EBITDA quite clearly as being an earnings metric, not a cash flow metric. How we should treat SBC in a company valuation is a bit more of a debatable question, but whether or not SBC should be treated as a real expense in an accrual-based income statement is not. On my estimates, Intuit generates roughly a 30% EBITDA margin each year going forward.

I end up with a 23% net income margin in FY 2022, which rises gradually to 25% by FY 2030. This leaves diluted EPS as growing in the high teens from FY 2023 to FY 2030. I also assume that Intuit continues to pay out ~30% of net income as dividends.

Intuit is a highly cash generative business and converts 85-90% of EBITDA into free cash flow, on my estimates. One the main drivers of this is capital efficiency. If you adjust for excess cash, Intuit has negative net working capital, meaning that its management of revenue from customers versus payments to vendors acts as a de-facto source of financing for the business. To illustrate this, I calculate days sales outstanding in FY 2021 to have been 15 days versus days payables outstanding of 33 days, in other words a negative cash conversion cycle of minus 18 days. Often negative net working capital is seen as unsustainable in the sense that a business cannot squeeze vendors on payment terms indefinitely. But in this case I think it reflects the the velocity of a software-based product, where payment is often made immediately upon receiving the service (and sometimes upfront), compared to relationships with vendors where payments are often made on 30 day terms. I expect negative net working capital to continue, therefore, and to be a key driver of free cash flow for the business.

This dynamic also shows up in Intuit’s return on invested capital (ROIC). Worth noting here again that in my calculations I attempt to adjust for excess cash, which is more art than science. I estimate that ROIC declines from ~95% in FY 2020 to ~35% in FY 2022, reflecting the build up of goodwill related to recent acquisitions, but then rises back up toward 100% by FY 2028. If you break this down into its component parts, NOPAT margin remains at a healthy 23-25% over the next eight years, but capital turnover rises from ~1.5x in FY 2022 to above ~5x in FY 2029, as more revenue growth is effectively funded by net working capital. It is very possible that Intuit makes more acquisitions in the future, causing additional goodwill to compress ROIC, but the underlying economic picture remains - this is a capital efficient and cash generative business.

In my forecast I try to avoid allowing too much excess cash to build up by estimating buybacks each year. Again, it is possible that they use cash for acquisitions instead, but I would rather not speculate on that.

Valuation

My main approach to valuing Intuit is to estimate intrinsic value per share via a DCF. As a brief aside, I used to be quite disparaging about DCFs as an approach to valuation. They struck me more as an academic exercise than real-world attempt to assess whether or not a stock is attractive. But when it comes to companies like Intuit, that offer long-term growth in revenue and free cash flow and that are optically trading at high multiples (along with the rest of their sector), I find a DCF to be a useful tool, even if imperfect. This is especially the case in today’s environment, when two of the key variables - yields and equity risk premiums - are changing rapidly. Having a DCF in place allows me to flex the impact of these variables on my implied valuation.

I estimate a 9.3% WACC for Intuit using the parameters below:

I project free cash flow discretely through FY 2030 and thereafter estimate continuing value using a 4% long-term growth rate. Discounting this all back to today I end up with an intrinsic value per share of $484, representing 5% upside from the share price as of the time of writing.

I cross-checked this by calculating the theoretical IRR for an exit in FY 2030. If I use a a Price/FCF multiple of 20x on FY 2030 free cash flow, then I get an exit value per share of $829. Buying the stock today (08/19/22) and selling the stock in eight years for that amount, as well as receiving the dividends in between, yields an IRR of 9.9%, slightly higher than the company’s cost of capital.

The comparative valuation looks ok. Per the tables below, the stock is trading above the median peer group multiple for EV/Revenue, but is trading at a discount for EV/EBITDA and P/E multiples. Intuit offers a higher free cash flow yield than the peer group median in the first year, but thereafter is in line or below. Profitability, as measured by ROE, is better than the peer group median.

Given Intuit already generates high returns on capital, the equity story hinges primarily upon revenue growth. My growth forecasts are more conservative than company guidance and are also slightly below consensus, so there is potential for outperformance should the company manage to grow at or above guidance. But as a rule I like to include a margin of safety in the valuation of any stock, which here I accomplish by being relatively conservative on revenue growth. The fact that the resulting valuation aligns pretty much with the current stock price implies to me that the price today lacks a margin of safety and so the company would need near-perfect execution (defined here as hitting growth targets) to outperform.

That all said, the biggest factor here, of course, is rates. If I assume a risk free rate of 1.5%, which is roughly where the US 10 year was trading last summer, then I get upside of nearly 50%.