Musings on Cloud Kitchens

Brief thoughts on whether the economics of cloud kitchens / dark kitchens stack up

Last year I did kind of a side hustle research project that never went anywhere, in which I tried to analyze the potential economics of so-called cloud kitchens, also known as dark kitchens or ghost kitchens or virtual kitchens. Cloud kitchens are centralized food prep facilities, divided into a number of individual kitchens optimized for food delivery. Restaurants rent these individual spaces to prepare food for online delivery (and/or takeout). The centralized cloud kitchen space acts a bit like an incubator.

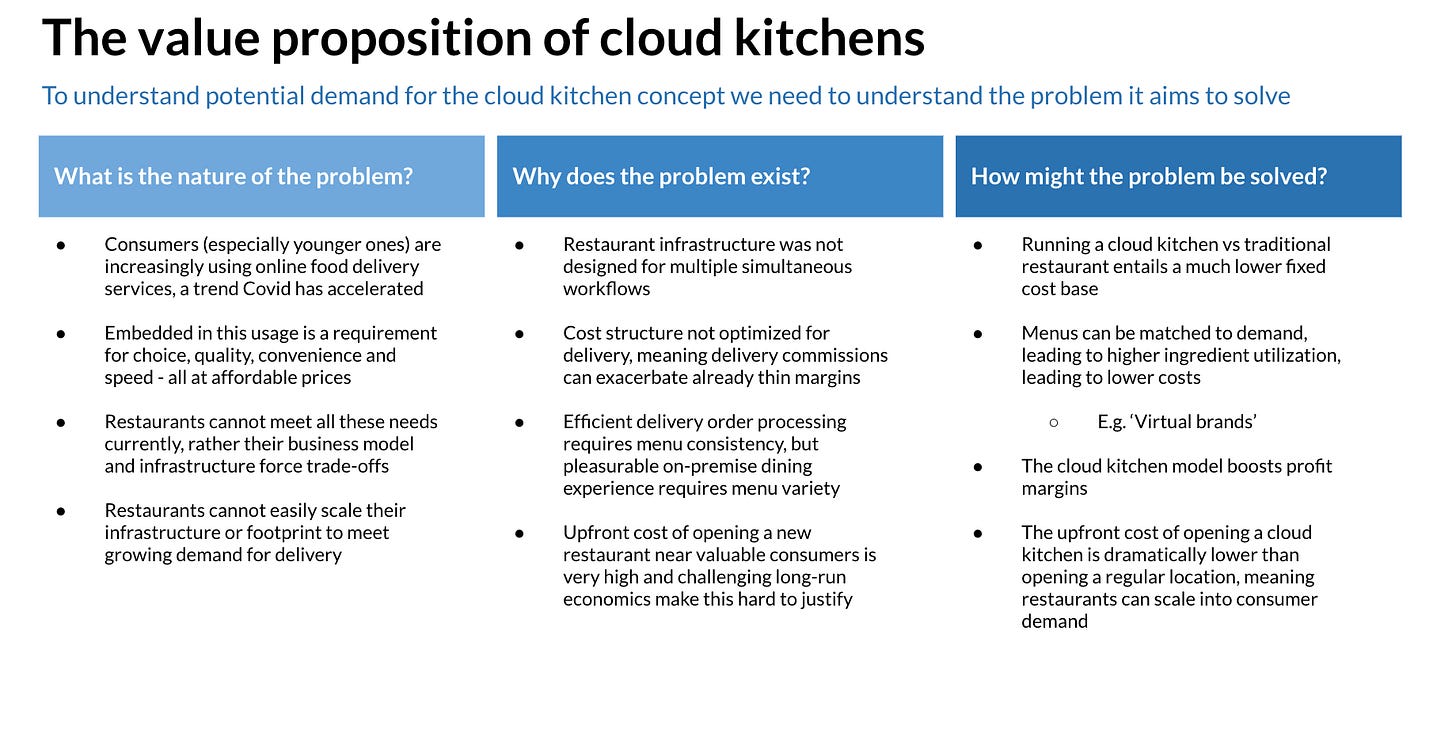

Picture a large warehouse with numerous stations of stainless steel prep tables, hood vents, stoves, ovens, and sinks, each with its own orders coming in direct from customers. In theory this helps restaurants cater better to demand for online delivery, because the space and cost structure of a normal restaurant was never designed to fulfill a large volume of online orders alongside managing an in-house service. This has meant that the ~30% commission charged by Doordash etc can erode restaurant margins significantly. Renting a cloud kitchen would also allow a restaurant to start operating a new location without the significant capex normally associated with opening a new restaurant. Some restaurants also worry that changing their menu to serve items better suited to efficient online order fulfillment would pollute their brand. Cloud kitchens mitigate this risk by allowing restaurants to spin up multiple menus under ‘virtual brands’, allowing them to optimize operations without incurring brand risk.

The concept naturally has garnered quite a bit of hype. In the media this was fueled a while back by the fact that Uber founder and ex-CEO Travis Kalanick quietly went into this space via startup CloudKitchens and appears to be building out a footprint in the US and Latin America. In contrast to Uber, he appears to be maintaining a culture of secrecy in his new endeavour.

In my side hustle project, I attempted to estimate the potential market size for cloud kitchens in the US and assess whether or not the economics work both for the restaurant renting the kitchen and the company/startup leasing the centralized premises. Since I did this last year, some of the numbers are probably out of date, but I thought that it might be worth sharing, as I found it an interesting thought exercise.

Below I paste the slides from the presentation I put together, the full version of which you can find here.

If anyone has done work on this concept, I would love to hear how my assessment matches your own views. Since this is a nascent business model, it strikes me there must be quite a range of opinions out there regarding the model’s longevity.

Presentation Slides

I started the presentation by examining, in the first place, what the value proposition of cloud kitchens is.

Then I moved on to estimating the total addressable market size for cloud kitchens in the US. No doubt this is highly imprecise and will be far off the eventual mark, but TAM estimation exercises can be helpful at least in figuring out with some rigour whether the market for a new product or service could be…err…big…or…small.

In the next section I tried to estimate potential unit economics for a restaurant operating a cloud kitchen and a startup leasing a cloud kitchen to said restaurant. I did this by creating a hypothetical P&L for one cloud kitchen from the perspective of each party. One shortcoming of this analysis from the perspective of the startup is that it does not consider occupancy rate, it looks only at one individual cloud kitchen within a centralized premises.

I finished with some high level thoughts about the key parameters of the cloud kitchen model that either make or break it. Unsurprisingly the number one variable is the order volume the restaurant is able to generate. But also important to how the economics are distributed between the kitchen and the startup is the commission rate the startup charges the restaurant on order revenue.

Like I said, some of these numbers may be out-of-date now, given I put the presentation together over a year ago, but I hope this might be an interesting thought exercise to read through in any case. If anyone has done any work on this topic that either aligns more or less with the above or invalidates it, then I would love to hear about it!